London Property Match April Newsletter

Hello and welcome to our April newsletter

With Easter behind us and, hopefully, the rain, are we be brave enough to say Spring is in the air? With this in mind and the Chelsea Flower Show just around the corner, we thought we would focus on garden and green spaces in our April newsletter. We also have a report in our regular feature on new developments and include another of our top ten – this time on what to watch when investing in a ‘buy-to-let’.

With Easter behind us and, hopefully, the rain, are we be brave enough to say Spring is in the air? With this in mind and the Chelsea Flower Show just around the corner, we thought we would focus on garden and green spaces in our April newsletter. We also have a report in our regular feature on new developments and include another of our top ten – this time on what to watch when investing in a ‘buy-to-let’.

Green Fingers, Green Spaces

A large percentage of buyers that instruct us have outside space on their “wish list”. This can be anything from access and use of a roof terrace to a garden of varying sizes. If you do own some outside space making it attractive does not have to be difficult, expensive or time consuming. Do look at our Pinterest board for ideas.

We have had clients whose number one priority is a south or west-facing garden, so it is important to note the orientation of your garden when buying. South or west-facing is preferred for the light. Not being overlooked is another important factor to think about. This can be hard in London, but it is achievable.

Artificial grass (or London Grass as an agent once told us) is becoming more and more popular, particularly now that it can be hard to tell the difference from real grass and is dog friendly. For those with north or east-facing gardens, artificial grass might be worth considering as it is certainly preferable to a mud patch. Certainly, buyers will take note of how your outside space looks, so do bear this in mind.

Artificial grass (or London Grass as an agent once told us) is becoming more and more popular, particularly now that it can be hard to tell the difference from real grass and is dog friendly. For those with north or east-facing gardens, artificial grass might be worth considering as it is certainly preferable to a mud patch. Certainly, buyers will take note of how your outside space looks, so do bear this in mind.

If your budget or desire does not extend to owning some outside space, access to a park or common is always a very positive feature.

Our favourites parks are: Battersea Park with its boating lake, adventure playground, sporting facilities and children’s zoo, Kensington Gardens with the Diana Memorial playground, Serpentine and Kensington Palace and Ravenscourt Park, which is always full of people being very active! The combined space of Clapham and Wandsworth Commons for the large amount of open, green land, playgrounds, ponds and playing fields it offers is one of the reasons that this area is so popular.

New Developments, New Openings

This will be a regular feature in our newsletter and here we will give you a heads up new building and housing projects, shops and restaurants that are coming to an area near you soon.

BBC centre – Better than the normal ‘new build’

So often new build developments are a disappointment with poor dimensions, volume and finish as well as lacking in character. Located in White City, just north of Shepherd’s Bush, the old BBC Television Studios have been redeveloped and it is a pleasant break from the norm. How super to see a modern residential development finished to such a high specification and incorporating some real plus points relating to the original purpose of the site. As well as over 900 residential flats there is a cinema, health club, pool, spa, private members club and hotel, restaurant and communal gardens. There are also still some TV studios for live recording and they have kept some great original features such as the mid-century tiled façade with Crittall windows and Helios statue – keeping it grounded to its roots.

There is a little taster video of the show home in the Evening Standard. Link attached:

https://www.homesandproperty.co.uk/property-news/buying/first-look-inside-former-bbc-tv-centre-homes-950-new-homes-set-to-go-on-sale-at-iconic-white-city-hq-a100781.html

Location, location, location

When considering a buy-to-let investment there are two important factors to bear in mind: yield (income return on your investment) and capital growth.

When considering a buy-to-let investment there are two important factors to bear in mind: yield (income return on your investment) and capital growth.

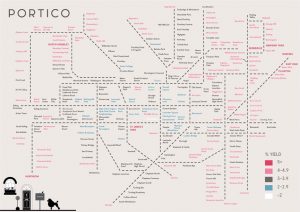

The clever map courtesy of Portico shows you where you will find the higher yields in London.

Capital growth is as important, in our opinion, and is usually down to a “good” location but it’s also important to avoid void periods and to be able attract tenants quickly. Our Top Ten Tips for buying a property investment we share with you below.

Top Ten Tips for……for what to watch when investing in a ‘buy-to-let’

- Access to transport. Proximity to transport has to be one of the most important factors when considering a buy-to-let investment.

- Equal sized bedrooms. If buying more than a one-bedroom property, try and get equal sized bedrooms. This makes it easier to maximise rent with sharers.

- Number of bathrooms. Ideally there should be one bathroom for each bedroom.

- Condition. Tenants like properties in good condition that they can visualise themselves living in without hassle of future repairs or improvements. This helps avoid long void periods.

- Proximity to amenities – buy as close as possible, but not so close tenants will be affected by noise and disruption of deliveries or cooking smells from restaurants. You want to avoid the cost of a frequent turnover of tenants.

- Service charges. Although swimming pools, gym, parking spaces and porters all attract tenants it will be you, the owner, paying for the service charge of the flat (if buying in a purpose-built block). Watch out for these as they can be large and cannot be recouped easily in the rent.

- Check the lease. Many leases exclude the right to let it out. Check before you buy.

- Buy “well”. You are not only buying the flat to let well but also as a capital investment. Avoid upper floors (without lifts), lower ground floors (basements), buying on noisy and busy roads, above commercial premises as it will be hard to sell on when the time comes.

- How will you manage the let? Will you manage the flat yourself or will you pay someone to do it for you. You may save money doing it yourself but a good letting manager may be able to save you time and possibly money in the long run.

- Ensure you understand and adhere to all legal and safety guidelines. It is imperative you ensure your tenants safety and run your business professionally (even letting out just one flat, is a small business after all).